Handles ESG Heterogeneity

Easily configures the challenges of Heterogeneity in ESG Frameworks

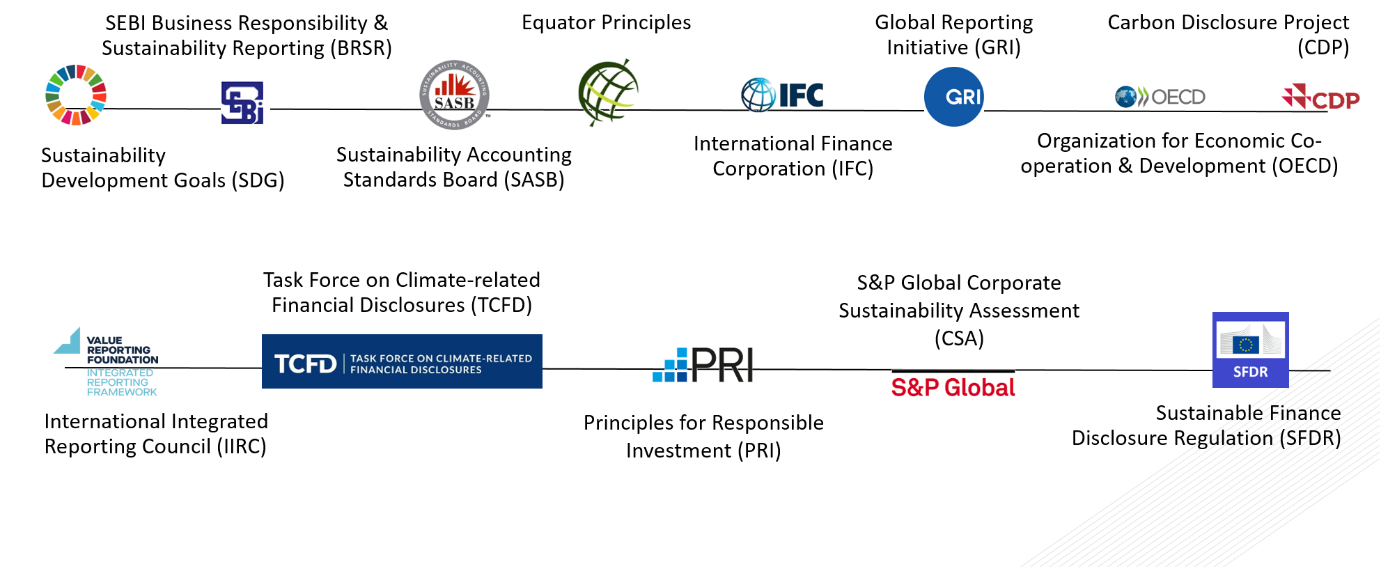

Following a centralized approach to manage your ESG requirements, we provide a collection of aggregated data on various performance standards across the globe. The centralized repository enables companies to manage its reporting and assessment across business units. We facilitate individual ESG focused assessment on different standards including GRI, TCFD, BRSR, UN PRI and so on.

All logos, icons, and domain are proprietary to the respective organisations. Nothing contained on the website should be construed as granting, by implication, estoppel, or otherwise, any license or right to use logos, icons, and domain names displayed on this website.

Helps in Avoiding Greenwashing

Creates trails & evidence to safeguard by periodic reporting & audits

ESG greenwashing is in disguise cheating upon your stakeholders. To get micro control of your adherence to local laws of the country configuring all laws is a pre-condition to any disclosures in annual report or public domain. In esgfit.in every law in India has been given a ESG quotient and all relevant compliances within acts/rules applicable have been configured. For all countries other than India in our unique methodology of DIY & DIFM, please raise a request here for our team to connect and configure the entire gamut of laws and their respective ESG Obligations. Truly first of its kind offering globally!

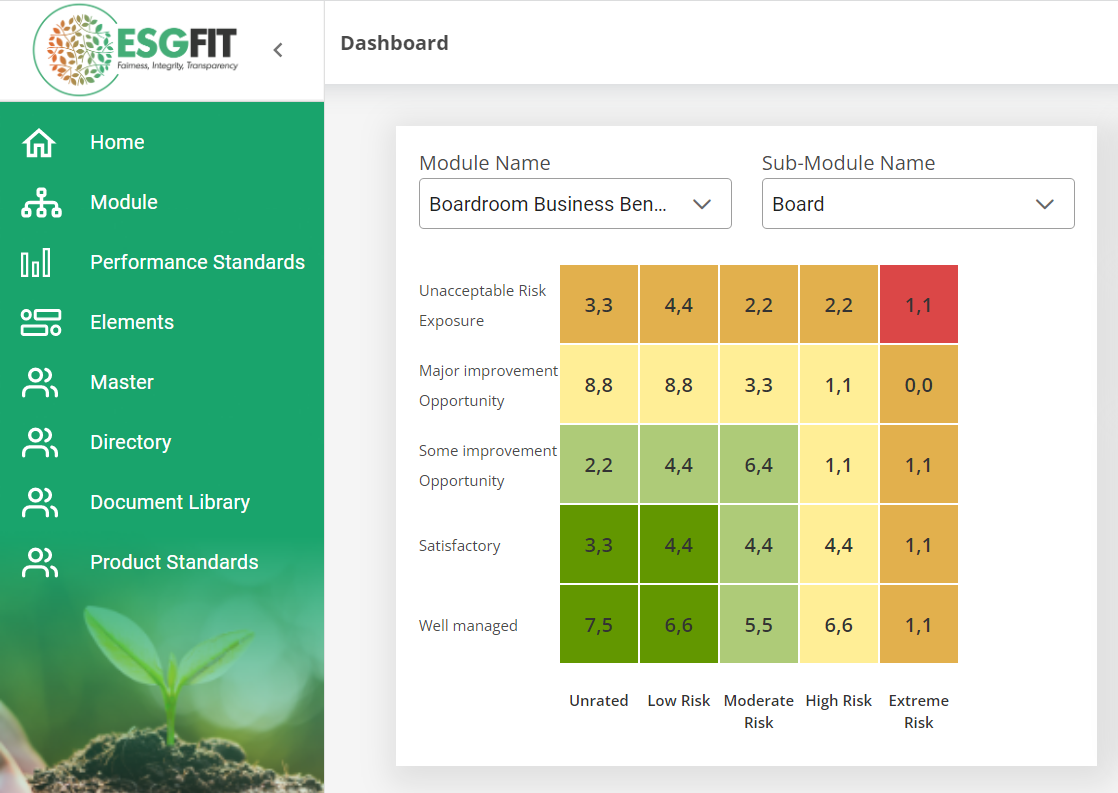

Visual BI (Business Intelligence) for Management Planning

Heat Maps on ESG elements gives the management tangible decision-making information e.g., resource allocation, CAPEX, OPEX, underperforming ESG Elements etc. Our risk assessment is based on a comprehensive evaluation of company disclosures made against benchmark global practices. Based on the output shared by the company, our software generates a heat map showcasing the company’s performance against different ESG risks and opportunities associated with the business operations. It provides a holistic overview of the company’s global standing on the ESG front.

Centric to Investors

Fairness, Integrity & Transparency is key for any investor on ESG. ESGFIT.in gives the investment community visible BI on various ESG parameters and helps them for their UNPRI, GSA etc. reporting commitments on investee companies.

DIY for Popular ESG Standards

Proprietary Governance review module BBBE (Boardroom, Business, Benchmarking & Evaluation)

More than 500 review data points in governance being researched as per Indian Stock Exchanges, NYSE, Singapore & Australia. A must for the G Part in ESG.

DIFM for other ESG Performance Standards